Happy MLK Day

In celebration of Martin Luther King Jr Day later this month, I will examine how racial inequity has impacted real estate, not only in the past, but in the recent decades as well.

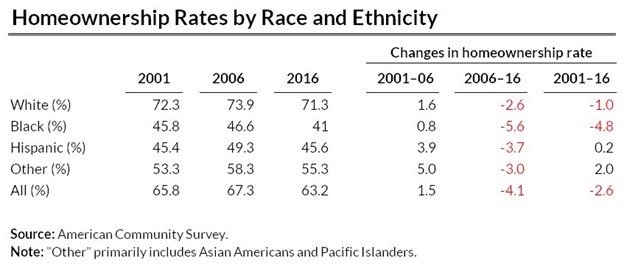

Since 2001, the black homeownership rate has seen the most dramatic drop of any racial or ethnic group, declining 5 percent compared with a 1 percent decline for white families and increases for Hispanic and “other” families, which primarily include Asian Americans and Pacific Islanders (AAPIs).

The cohort of black Americans that has lost the most ground relative to other racial and ethnic groups is middle-aged homeowners ages 45 to 64. These homeowners, having lost their homes during the 2008 crisis, find themselves unable to move back into homeownership as they approach retirement age.

Married black households—traditionally the most likely to own homes—lost more ground than single-headed black households. These trends will affect retirement prospects for black Americans and their ability to pass wealth to the next generation.

From 2001 to 2016, white families had higher homeownership rates than other groups. In 2001, black and Hispanic families had similar homeownership rates (46 percent), but by 2016, black families had fallen behind (41 versus 46 percent). The homeownership rate for all groups rose from 2001 to 2006, but it rose less for black families than for other races and ethnicities. And although the homeownership rate fell for all groups from 2006 to 2016, it fell more for black families.

The homeownership rate for black families fell 5 percent. White families experienced a 1 percent drop, and Hispanic and “other” (primarily AAPI) families experienced increases. The 3 percent drop in the overall homeownership rate reflects changes in the composition of the general population.

In fact, black homeownership rates are now at levels similar to those before the passage of the Fair Housing Act in 1968, while rates are up for every other group.

What can be done?

Homeownership has historically been the best way to build wealth and remains, for most households, more financially beneficial than renting. Reduced access to this wealth-building tool is a significant problem. Since the financial crisis, qualifying for a mortgage has become difficult for people with anything short of perfect credit, blocking as many as 6.3 million loans between 2009 and 2015 alone.

One of the most important steps to help stabilize and increase the black homeownership rate is to expand credit availability, particularly for Federal Housing Administration lending, which black families turn to for 45 percent of their purchase loans.

In addition, allowing greater use of alternative data in mortgage underwriting decisions, including use of rental payment history, and some utilities would benefit black homebuyers. And we need a more thoughtful approach to recognizing the realities of income variability and a greater focus on consumer education and housing counseling related to building credit and using low– and no–down payment and down payment assistance programs.

These and other actions to increase credit availability could allow creditworthy black and minority families to obtain a mortgage and access homeownership’s wealth-building benefits.